As another year comes to a close, so my retirement, early or otherwise comes closer. I recently sat down to do something that I hadn't done in quite some time, evaluate my progress towards our earlier retirement.

One of my largest holdings in my IRA was HTE, which was recently acquired, and delisted. Therefore I find myself with 20% of my IRA sitting in cash at the moment. At first I considered investing in a CD, either short or longer term, in order to have some stability. After doing some calculations however, I figured that I still need to be aggressive with this IRA account if I want to reach my retirement goal.

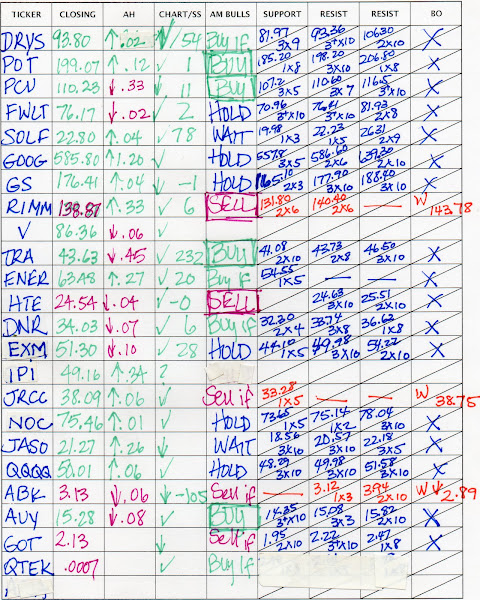

So, I decided to revisit my prior strategy of daily research on some select stocks, and seasonal plays. I am beginning with the daily stocks listed on my Daily Tracking List, and also a group of Natural Gas stocks. The natural gas seasonal play goes from the end of February to the beginning of June. I have begun with 14 stocks from the sector, and will start weeding them down to between 3 and 5. Once I have the list down to 5, I will start screening for a seasonal play for Healthcare Providers which begins early which begins the end of March.

It is hard for me to believe that a year and a half has gone by since I have posted here, but it has. That was a long vacation, but I'm back now, and ready to work! Make sure to visit my Day Trading Research Blog, for research updates.

Always perform your own due diligence before making any investment.

Friday, January 1, 2010

Happy New Year!

Saturday, July 19, 2008

Off topic ~ Sunflowers

I awoke this morning to the opening of the first sunflower in my garden. Enjoy.

Always perform your own due diligence before making any investment.

Saturday, June 21, 2008

Seasonal Plays part 2

Well, June is off to a rocky start for me, but quadruple witching expiry is now behind me, and with the expiration of some poorly held option positions, I finally feel that I have enough of my research time freed up to start looking forward to the seasonal plays that start the end of July, which I outlined briefly in this post.

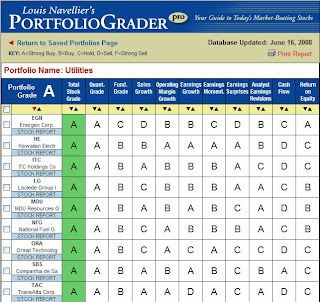

Because I wanted to pick some stocks to play rather than the index itself, my first "need" was to sort through a lot of stocks to decide which was the right one. I think that part of being a good trader, like any other job is knowing your strengths and weaknesses, and right now my biggest weakness is fundamental analysis. I could try and look at the inner workings of a company, their earnings information, etc. and figure out if they are a company I want to invest in or not, but I would really just be stumbling around in the dark and guessing. So, rather than personally evaluating all of the companies in these sectors to find the stars, I entered their ticker symbols into Navellier's Portfolio Grader and let that do the fundamental analysis for me. You do need a subscription to one of his newsletters to get access to this tool.

So, I started a portfolio for each of my three sectors and then let it run. I sorted the companies by total stock grade. For Biotech and Gold and Silver, I eliminated any company with a grade of C or less. Utilities had so many A companies that I eliminated everything from B or less. Here are the results. You can click on any image on this post to enlarge it.

While that procedure reduced my list to 19 stocks, I wanted to get down to about half of that for my daily research. I was trying to decide how I was going to do this. One of the things that I have come to feel lately, is that while the Prophet Charts that I have been using since before I started day trading full time gives me some good information, I think there are better charts out there to meet my needs. One of the systems that I have seen used a lot, and seems very powerful is at stockcharts.com. So, I decided today was as good a day as any to start working with it. My initial thought was that I would look at each candlestick chart individually for patterns etc, and try to narrow my list down from there. I went to free charts and started with Sharp Charts. When I scrolled down to add a moving average line to the chart, I saw a link that said Interactive Performance Chart and saw that you could create one 200 day chart that compared the performance of up to 10 symbols! Well, what could be easier than that? So, I created three charts, one for each of my three seasonal sector plays and here are the results. Again, you can click on any image to enlarge it.

So, using these two elimination processes, I have gone from a list of hundreds of stocks to the following nine stocks that I will be tracking, stocks listed by performance.

So, using these two elimination processes, I have gone from a list of hundreds of stocks to the following nine stocks that I will be tracking, stocks listed by performance.Biotech (Season end of July to beginning of March)

1. ILMN

Company Events

Illumina, Inc. engages in the development, manufacture, and marketing of integrated systems for the analysis of genetic variation and biological function. It provides a line of products and services that serve the sequencing, genotyping, and gene expression markets. The company's single-nucleotide polymorphism (SNP) genotyping product consists of Array Matrix, which uses a universal format that allows it to analyze various sets of SNPs, as well as offers Human 1M DNA Analysis BeadChip that combines an unprecedented level of content for both whole-genome and CNV analysis; HumanCNV370-Duo BeadChip, which enables researchers to analyze two samples simultaneously and access novel content for detecting disease-relevant CNV regions; and HumanHap550-Duo BeadChip. The company also provides BeadStation, a system for performing genotyping, which comprises BeadArray Reader, a scanning instrument that uses a laser to read the results of experiments that are captured in its instruments and genotyping and/or gene expression analysis software; and oligos, which are components of the reagent kits for its BeadArray products and are used for assay development. In addition, the company develops and commercializes genetic analysis technologies used for various analyses, including whole genome resequencing, gene expression analysis, and RNA analysis. It has collaborations with Invitrogen Corporation for the manufacture, marketing, and distribution of oligos; and deCODE genetics, ehf. to develop and commercialize diagnostic tests for variants in genes involved in disease related pathways linked to heart attack, type 2 diabetes, and breast cancer. The company was founded in 1998 and is headquartered in San Diego, California.

2. BMRN

Company Events

BioMarin Pharmaceutical, Inc. develops and commercializes biopharmaceuticals for serious diseases and medical conditions. The company's product portfolio comprises approved products and multiple investigational product candidates. Its approved products include Naglazyme (galsulfase), a recombinant form of N-acetylgalactosamine 4-sulfatase enzyme used for the treatment of genetic disease called mucopolysaccharidosis VI; Kuvan (sapropterin dihydrochloride), a proprietary synthetic oral form of 6R-BH4, a naturally occurring enzyme co-factor for phenylalanine hydroxylase indicated for patients with Phenylketonuria (PKU); and Aldurazyme (laronidase) that is used for the treatment of mucopolysaccharidosis I caused by the deficiency of a lysosomal enzyme called alpha-L-iduronidase. The company also develops various product candidates for the treatment of genetic diseases, which include PEG-PAL, a preclinical enzyme substitution therapy for the treatment of severe PKU; PEG-PAL for phenylketonurics, which are not BH4-responsive; and BH4 for the treatment of various other indications, including cardiovascular indications. In addition, it conducts preclinical development of various other enzyme product candidates for genetic and other diseases, as well as an immune tolerance platform technology to overcome limitations associated with the delivery of protein-based pharmaceuticals. Further, the company holds rights to receive royalties related to Orapred and Orapred ODT as a result of sublicense of North American rights. BioMarin Pharmaceutical sells its products to specialty pharmacies, hospitals acting as retailers, and pharmaceutical wholesalers in the United States, Canada, Japan, and the European Union. It has a strategic alliance with Merck Serono S.A.; collaboration with IGAN Biosciences; and joint venture with Genzyme Corporation. The company was founded in 1996 and is headquartered in Novato, California.

3. GILD

Company Events

Gilead Sciences, Inc., a biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics for the treatment of life-threatening infectious diseases. Its products include Truvada, Viread, Atripla, and Emtriva for the treatment of human immunodeficiency virus infection in adults; Hepsera, an oral formulation for the treatment of chronic hepatitis B; AmBisome, amphotericin B liposome injection to treat serious invasive fungal infections; Flolan, an injected medication for the long-term intravenous treatment of primary pulmonary hypertension and pulmonary hypertension; and Vistide, an antiviral medication for the treatment of cytomegalovirus retinitis in patients with acquired immunodeficiency syndrome (AIDS). The company also offers Tamiflu, an oral antiviral for the treatment and prevention of influenza A and B; Macugen, an intravitreal injection for the treatment of neovascular age-related macular degeneration; Letairis, an endothelin receptor antagonist for the treatment of pulmonary arterial hypertension in patients with WHO Class II or III symptoms; and Cicletanine, which is being evaluated for the treatment of pulmonary arterial hypertension. Gilead Sciences has operations in North America, Europe, and Australia. The company has research collaborations with Abbott Laboratories, Inc.; Novartis Institutes for BioMedical Research, Inc.; Novartis Vaccines and Diagnostics, Inc.; Genelabs Technologies, Inc.; Achillion Pharmaceuticals, Inc.; Japan Tobacco, Inc.; Parion Sciences, Inc.; LG Life Sciences, Ltd.; and University of Texas System. It also has commercial collaborations with Astellas Pharma, Inc.; Emory University; F. Hoffmann-La Roche, Ltd.; Pfizer, Inc.; Dainippon Sumitomo Pharma Co., Ltd.; OSI Pharmaceuticals, Inc.; GlaxoSmithKline, Inc.; Japan Tobacco, Inc.; and Bristol-Myers Squibb Company. The company was founded in 1987 and is headquartered in Foster City, California.

Gold and Silver (Season end of July to end of September)

1. GG

Company Events

Goldcorp, Inc., together with its subsidiaries, engages in the acquisition, exploration, development, and operation of precious metal properties in Canada, the United States, Mexico, and central and South America. It focuses on gold, silver, copper, lead, and zinc. The company owns a 100% interest in the Red Lake gold mine located in the District of Kenora in northwestern Ontario, which includes the Red Lake Complex comprising 89 patented claims covering 1,254 hectares, and the Campbell Complex comprising 77 patented mineral claims covering 1,084 hectares. It also owns a 100% interest in the Porcupine gold mine in Canada, a 100% interest in the Musselwhite gold mine in Canada, a 66 2/3% interest in the Marigold gold mine in the United States, a 100% interest in the Wharf gold mine in the United States, a 100% interest in the Eleonore gold project in Quebec, a 40% interest in the South Arturo gold exploration project in the United States, and a 100% interest in the Imperial gold exploration project in the United States. In addition, the company has 100% interests in the Los Filos gold mine, the El Sauzal gold mine, the San Dimas gold-silver mines, the Nukay gold-silver mine, and the Penasquito gold project, which are located in Mexico; a 37.5% interest in the Bajo de la Alumbrera gold-copper mine in Argentina; a 100% interest in the Marlin gold-silver mine in Guatemala; a 100% interest in the San Martin gold mine in Honduras; a 40% interest in the Pueblo Viejo gold development stage project in the Dominican Republic; and a 100% interest in the Cerro Blanco gold project in Guatemala. Goldcorp, Inc. was founded in 1954 and is headquartered in Vancouver, Canada.

2. KGC

Company Events

Kinross Gold Corporation engages in mining and processing gold and silver ores with a principal focus on gold, as well as in the exploration for and the acquisition of gold bearing properties in the Americas, the Russian Federation, and internationally. The company owns a 100% interest in the Fort Knox open pit mine, mill, and mineral claims covering approximately 19,682 hectares located to the northeast of the City of Fairbanks, Alaska in the United States; and an 80% interest in the Gil property mineral claims comprising approximately 2,521 hectares located contiguous to the Fort Knox claim block. It also holds a 100% interest in the Paracatu mine, including an open pit mine, process plant, tailings dam area, and related surface infrastructure located to the north of the city of Paracatu, situated in the north western portion of Minas Gerais State, Brazil; and the Maricunga heap leach mine consisting of 5,900 hectares located in the Maricunga District of the Region III of Chile. In addition, the company owns a 75% interest in the Kupol gold and silver project in the northeast region of the Russian Federation and a 49% interest in the Cerro Casale project located in the Maricunga District of the Region III of northern Chile. Kinross Gold Corporation also holds a 50% interest in the Round Mountain gold mine in Nevada and a 100% interest in the Kettle River mine in Washington, the United States; a 50% interest in the Crixas mine situated in Brazil; a 100% interest in the La Coipa mine located in the Atacama Region of northern Chile; and a 90% interest in the Julietta mine in the Russian Federation. As of December 31, 2007, its proven and probable mineral reserves were 46.6 million ounces of gold and 77.0 million ounces of silver. The company was founded in 1972 and is based in Toronto, Canada.

3. AZK

Company Events

Aurizon Mines, Ltd. engages in the acquisition, exploration, development, and operation of gold properties in North America. It owns a 100% interest in the Casa Berardi project, a gold-producing mine property comprising of 299 mineral claims and 2 mining leases covering a total of 16,637.17 hectares located in the Abitibi region in the Province of Quebec, Canada. The company also owns interests in 3 claims; and holds options to acquire a 100% interest in 87 claims and an option to acquire a 75% interest in 2 claims in the Joanna gold project covering 2,608 hectares located approximately 20 kilometers east of Rouyn-Noranda, Quebec. In addition, it has interests in the Kipawa gold uranium project with 1,277 mineral claims covering approximately 75,000 hectares located approximately 100 kilometres south of Rouyn-Noranda, Quebec. Further, Aurizon Mines, Ltd. holds royalty interests in the Beaufor Mine with an area of approximately 92 acres located 16 kilometers east of Val d'Or, Quebec. The company was founded in 1988 and is headquartered in Vancouver, Canada.

Utilities (Season end of July to beginning of January)

1. EGN

Company Events

Energen Corporation, an energy holding company, engages in the development, acquisition, exploration, and production of oil, natural gas, and natural gas liquids in the United States. It also involves in the purchase, distribution, and sale of natural gas to residential, commercial, and industrial customers, as well as other end-users of natural gas in central and north Alabama. In addition, the company provides gas transportation services for industrial and commercial customers located on its distribution system. As of December 31, 2007, Energen Corporation had proved oil and gas reserves of 1,754 billion cubic feet equivalent in the San Juan Basin in New Mexico and Colorado, the Permian Basin in west Texas, and the Black Warrior Basin in Alabama. The company was founded in 1929 and is headquartered in Birmingham, Alabama.

2. LG

Company Events

The Laclede Group, Inc., a utility holding company, engages in the retail distribution and sale of natural gas in eastern Missouri. As of September 30, 2007, it served approximately 630,000 residential, commercial, and industrial customers in the City of St. Louis and parts of 10 other counties. The company also involves in underground locating and marking service businesses primarily in the utility and telecommunications sectors, as well as in the non regulated marketing of natural gas and other services to both on-system utility transportation customers and customers outside of its traditional service area. In addition, it operates a pipeline that connects the propane storage and vaporization facilities to third-party propane supply terminal facilities located in Illinois. Further, the company involves in the development of real estate properties and the provision of services for the compression of natural gas to third parties, as well as offers insurance agency services. The Laclede Group was founded in 1857 and is based in St. Louis, Missouri.

3. NFG

Company Events

National Fuel Gas Company, through its subsidiaries, operates as a diversified energy company. It operates in five segments: Utility, Pipeline and Storage, Exploration and Production, Energy Marketing, and Timber. The Utility segment offers natural gas transportation services to approximately 725,000 customers in Buffalo, Niagara Falls, and Jamestown in New York, as well as in Erie and Sharon, Pennsylvania. The Pipeline and Storage segment provides interstate natural gas transportation and storage services for affiliated and nonaffiliated companies through an integrated gas pipeline system extending from southwestern Pennsylvania to the New York-Canadian border at the Niagara River and eastward to Ellisburg and Leidy, Pennsylvania; and 32 underground natural gas storage fields. This segment also transports natural gas for utilities, industrial customers, and power producers in New York through a 157-mile pipeline. The Exploration and Production segment engages in the exploration, development, and purchase of natural gas and oil reserves in California, Appalachian region of the United States, Gulf Coast region of Texas, Louisiana, and Alabama. As of September 30, 2007, this segment had U.S. reserves of 47,586 thousand barrels of oil and 205,389 million cubic feet of natural gas. The Energy Marketing segment markets natural gas to industrial, commercial, public authority, and residential end-users in western and central New York, and northwestern Pennsylvania. The Timber segment markets timber; owns two sawmill operations; and processes timber primarily of hardwoods. The company also develops and operates mid-range independent power production and landfill gas electric generation facilities. National Fuel Gas Company was incorporated in 1902 and is based in Williamsville, New York.

To view the daily research on these 9 companies and make your own seasonal plays, visit my Daily Trading Research Blog.

Always perform your own due diligence before making any investment.

Wednesday, June 18, 2008

Three new option positions

I said I wasn't going to, but I couldn't resist these three small option position pick ups today after Bush's speech. Not because they had a lot to do with his speech, so much as every time I hear his voice on t.v., the market starts tanking, and then recovers some time afterward. It is almost as if it is the short sellers cue to scare the masses out of their positions. I think I will nick name this phenomenon the "chimp dip". Think it will catch on?

TRA 60 calls was my first buy. I bought the stock, and it has performed very well. I have calculated 7 to 10 more points to target from 55, so I decided to grab a couple of calls. I got in fairly reasonably, and am up about 15% as of close.

Next I grabbed some ENER 85 calls. This one has gone parabolic lately. If you view the chart, the two long white candles prior to this one had a couple of days of consolidation with the lows hitting about half way down the candle, and then starts the next leg up. These calls ended the day even.

Click image to enlarge.

JRCC and PCX continue to climb. I have a very small JRCC equity position, that I am up 80% in just a little over a month in my IRA. Coal is hot right now, and I don't want to miss out on any more of this opportunity than I have. However, we have a strange few weeks coming up. The fourth of July is half way between now and July option expiration, which means two weeks out of the next four are going to be very unpredictable. So, rather than purchase options that are a bit out of the money as I normally do, I will purchase just one in the money contract, and trade it as if it were an equity. I may have some time value issues, but it shouldn't compare with the profits made if the coal stocks continue on their parabolic path.

Google continues downward in it's channel, which is expected but rough on my account balance as I hold a few shares in both my IRA and trading account. I will add more as it approaches 543, and keep an eye out for a break down.

V also on watch as it is having difficulty breaking through 85. This may be a bad sign, or it may just be because option expiry is in two days. Either way, the chart is teetering on a breakdown, and I am keeping a close eye on it.

Always perform your own due diligence before making any investment.

Tuesday, June 17, 2008

Position Reviews 6/17/08

Just wanted to review a couple of positions that I am holding, and document the charts for them as of today. Some may have been mentioned in other posts, some haven't.

Picked up some JASO today at 21.28. I liked this chart last night and put a bid in at 20.88, but it took off without me. I didn't want to chase, but did want to get in on the double top trend reversal, so I raised my bid to just over the confirmation line at 21.28. The stock went as high as 22.35, and at some point I stopped watching it to concentrate on other holdings. Looked up and it was below my fill. JASO ended the day down, with an inverted hammer. This could mean that our double top pattern had just pulled back, and is getting ready for it's next leg down. A break below 20 tomorrow would take us out of our upward trading trend.

I flipped TRA calls several times as the symmetrical triangle formed. I was out of the calls once the break out confirmed, but once I realized that I could still make a good profit from the break out trade, I started looking for an in on Friday. Determined not to chase the ask, I did not get a fill Friday, only to find that the price had gapped up on Monday. This is a good indication that the stock is going to move well. I got in on this trade Monday after a little chasing at 51.88. Target is in the range of 62.00 to 65.01, but I will let the stock tell me when it is ready to start heading back down.

HTE and GOT both moving slowly, but trending upward out of their breakouts. Close eye out for a throw back on these. As updated in this post, FWLT also on close watch for a possible trend reversal.

PCU is in a downward trending channel. Need to see a break above 110. I have a very small position. I wont sell red, but may average down if it dips lower.

V: Needs to clear resistance at 87 on this upswing. On watch for a triple top, then look out below!

Always perform your own due diligence before making any investment.

Monday, June 16, 2008

Chart Trading Ideas

Jaso: Target 26.58 to 29.88

ABK: Watch for bump and run break out over 2.85.

GOT: Confirmed breakout from descending triangle. Target 3.40.

Always perform your own due diligence before making any investment.

HTE confirmed breakout 6/16/08

It looks like HTE had confirmed a double bottom but then had a throw back, which formed a symmetrical triangle. HTE broke out of the symmetrical triangle today. If you are going to play HTE I suggest avoiding the options, there is not a lot of interest, and the stock pays you a .30 dividend monthly while the pattern unfolds.

Target range 26.97-28.20

Last year HTE peaked at 29.84 on 7/16.

HTE is one of the stocks I track daily. Click here for more HTE research.

Always perform your own due diligence before making any investment.

Sunday, June 15, 2008

Chart Education Part 2 ~ Symmetrical Triangle ~ Google

A symmetrical triangle is formed when the stock moves within a trading channel forming higher lows and lower highs as it progressive, giving a top trend line that is angled down, and a bottom trend line that is angled upward. Unlike some of the other patterns that I have studied, confirmation does not occur when the price paces a certain point. Confirmation occurs when the price touches the trend line at least twice on the top and twice on the bottom. By that criteria GOOG is already in a symmetrical triangle pattern, and we are waiting for the breakout. Also the price must cross the triangle several times, covering the white space.

Volume pattern tends to have a downward slope to it. I've drawn a line on the volume portion of the graph that is sloping downward, but it has only has 8 points actually touching the line. The last few days have volume going over the line. Look for trades with heavy volume on the breakout for maximum reward.

Breakout direction can be in any direction, including horizontal, but 54% of the time it will follow the prevailing price trend, which in the case of Google is upward.

Minimum length for a symmetrical triangle is 3 weeks.

Failures: When the price moves less than 5% and then returns to the triangle and then breaks out in the opposite direction, the move in the new direction is likely to be large. These failures occur just over 1/2 the time. Look for resistance/support (depending on breakout direction) before initiating your trade.

Before pronouncing a chart a symmetrical triangle look to the left. A mirror image may be a diamond top or bottom formation. Another minor high to the left of the triangle could be a head and shoulders formation. Both are more powerful formations, so make sure not to miss them.

On average, this pattern gives a 31% rise or decline, and 1/3 of the time you will get a 45% rise or decline.

As with EEDT, busted symmetrical triangle breakouts actually perform better. If you get a pull back after 5% or less move in one direction or the other, and then the price breaks out in the other direction, you definitely want to play that movement.

To get a conservative target price, subtract the price of the lowest low from the highest high in the formation and then add or subtract that to your breakout price. A higher target can be measured by adding the price at the start of the move leading up to the formation to the lowest low, and then subtract that from the highest high in the formation. Since the former measure is easier, and more likely to be fulfilled, I will use that one.

Symmetrical triangles are good for intraday trading. Buy near the support line, sell near the resistance until break out occurs. Since I like to channel trade, it is helpful to be able to recognize these patterns so I can cut my loses when I end on the wrong side of a trade.

Now, lets get down to the nuts and bolts of this Google chart.

CLICK ON IMAGE TO ENLARGE

The first step is to identify the pattern. We see that GOOG has a symmetrical triangle confirmed as it has four touches to the top trend line and three touches to the bottom trend line. They are in the formation of lower highs, and higher lows. The price has crossed the pattern completely 4 times, and is on it's 5th leg in the upward direction.

While we can see a breakout in either direction, the overall look of the GOOG chart points to a slightly better chance at the higher break out. Combining the pattern with my resistance levels from Stock Consultant, I will call an upward breakout at 587 on the current pattern. While I am not expecting a downward break, I will be on watch for it below 543. Note that the longer that GOOG stays in this pattern, the closer the two break outs come to each other (since we will continue to make lower highs and higher lows until the break occurs). I watch the chart daily so I will adjust potential breakout watches as necessary.

Our target measure will not change from now until the breakout, so we can calculate it by subtracting our lowest low from our highest high.

602.45-524.77 = 77.68

Using our current breakout watch numbers, we can conclude that an upward break of the pattern at 587 would give us a target of 664.68. A break downward at 543 gives us a target of 465.32.

Concentrating on the more likely break upward, we have some resistance areas we will need to overcome. First is 600. That is a big psychological resistance to get through. It shouldn't be a surprise that 602.45 is the high point of our pattern. Next is our 5% failure number, which happens to correspond with the triple top confirmation point from January. The pattern will bust if we can't push through to 613.00 without a throw back. If it fails here, we will need to keep a close eye to see if it breaks downward. A lot of money could be made on puts if this pattern was to fail. Next we have a psychological resistance at 650 which corresponds to the double top confirmation line at 652.50.

Referring to stock consultant though, the only resistance they show between the breakout at 587 and conservative target of 665 occurs at 640ish. This is good news for our chart.

So, my watch points for an upward breakout are

1. 587

2. 600-605

3. 615-620

4. 640

5. 665

Go Google Go!