Well, my blog here is one month old, and I have now been trading full time for about 3 weeks. In part one of this review, I am just going to lay out some October stats. In part two which I will put together this weekend, I will write up a more comprehensive review of what worked, and what I learned.

One thing that I learned today, and worked well for me, is when dealing with the short term, momentum trades, if you get in late, you need to get out early.

On October 1 the DOW opened at 13895.71. On October 31 the DOW closed at 13930.01. That's a gain of 34.30 points, or .25%.

While I wont be disclosing the dollar amounts of my portfolio, I will say that my portfolio had a total gain of 10.25% for the month of October. I do take money out for household expenses this month, so my net portfolio gain was 7.10%. I must say that I am extremely pleased with these results. I set myself a "dreamer" goal of a 10% portfolio increase each month, which translates to an amazing 120% annualized. That's buy a house on the coast and retire kind of cash, if it could be maintained. In reality, I would be doing fine to make 10% or so a year after expenses. What that works to for this first year, is a 30% annualized return, or 2.5% increase per month total. I know that every month is not going to be an up month. I know that I will have months when things look bleak, but I have to say, when I can beat the DOW by 10% when I am just starting out, you have to know that it gives me a great deal of confidence that my goals are attainable.

Always perform your own due diligence before making any investment.

Wednesday, October 31, 2007

Happy Halloween! October Review, Part I

Short Term Plays

Well, they are coming at me fast and furious, and I'm not really taking any of my own advice. One of the things that I did decide, however, is that I am no longer going to be including them in my portfolio on the blog. I will just limit that to my long term hold items. I need to save time where I can, I'd like to be able keep up with everything working 50 hours a week, but as my absence for a couple of trading days shows, it's not happening with everything I'm trying to do right now, so I need to trim some redundancies. I will from now on only add a ticker to my portfolio if I have bought it as a long term investment, or held it for more than a week if it was initially considered a short term.

I have mixed emotions about how my short term trading is currently going. I don't seem to have my timing down, and I'm trying to watch too many at once, which means that I am not decreasing the number of stocks in my portfolio, which has been a goal for a few weeks now.

Another goal is to get up at 5 am, and it's midnight now. I am going to run through and update my portfolio on here, and then check out for the night.

Fed comes out with the interest rate announcements tomorrow, I'm hoping that it will end the day on a positive note. I have several short term positions sitting on the brink of their upside targets. While I've been holding them longer than I had planned, I only have a couple that I think will end up being losers. Time will tell!

Always perform your own due diligence before making any investment.

Thursday, October 25, 2007

FLML ~ My favorite mistake

FLML is my favorite mistake, for the day anyway. This day trading is not for the timid or weak of spirit that is for sure.

As you can see by the chart below, I bought in around mid day (when I thought price would be good) at 11.17. It proceeded to head south, and then kept bouncing up to just under my price, and then go down again all afternoon. Disheartened that my timing was so poor, I stupidly put a sell order in for just a bit over my price at 11.23. Since there was at resistance at 11.25, I figured I would get a sell in before it bounced down again, in case I missed it.

Well, it worked in one way, that I did make 6 cents a share. The only problem is that had I not had that sell in I wouldn't have even see it hit 11.23 as it blew past it on it on the way up to the 12.75 area. I missed out on an additional 1.50 per share profit at least, on the sell side, and 40 to 50 cents on the buy side as well, had I been more patient.

So, the rainmans advice to me (thanks goingin60) was

"the mkt trades best 8am-10:30 then 3 pm to 4 pm-You can see that had I purchased this stock anytime between 8 and 10:30 and sold anytime on the way down off of 12.75 I would have maximized the profit and made much more than 6 cents on this trade, making it worth the round trip I took.

itll be in my book-

Rainman 101 for daytraders"

So, if I am going to learn to play these momentum stocks, I think that I need to make a few adjustments to my strategy.

First, I need to get up at 5 am instead of 6. I am not getting up and running quick enough to get in on the ground floor of these momentum moves. Next, I need to choose one stock to follow the momentum of for the day, and try to get in before 10:30 (7:30 my time). Third, watch throughout the day, but I need to assume the sell point is going to happen either the between 3 and 4 that day, or the next morning. Lastly, do not make the buy and sell on the same day unless there is a doubt that it will hold up for sale in the am.

Now, for the 4 short term trades I am still holding, and at a loss.

EGHT: Went up 5 cents in after hours, so it is down 2% since I purchased it at 1.48. It has to break resistance at 1.52. Earnings are being released on November 1, next Thursday, after market close at 4:30. I feel at this point I may as well commit another week to this stock to see what earnings release gets me. I'm a little nervous with the after hours release time. However, if this makes any kind of run past resistance at 1.52, I will

GNVC: Up 4 cents in after hours to 2.50, down 6% since my investment. This one is posing a difficulty for me to exit. While it has been trending mostly downward, it is staying above the support at the 50 day moving average. I don't even care about losing some money on this one at this point. I just want to minimize the loss the best I can. In fact, now that I have typed that out, I realize that the loss I would take at 2.50 is acceptable to me at this point, so I have put a sell order in for that amount. If it clears, I have one less stock to track, if it goes higher, oh well. I have no signs pointing to any upward momentum on this stock. Part of me would like to put the sell price at 2.55, as it has been at or above that price the past few days, however the more practical side of me says I don't want to lose the opportunity to get this one out of my portfolio over 5 cents.

NCST: Currently my biggest headache. No action, no news, the chart looks horrible. I am down 16% on this one as it stands at $2.31, and I have no support again until 2.16. I've got resistance at 2.50 and 2.63, and I have to get up to 2.75 just to break even on this one. To add insult to injury, this is the largest of my 4 short term investments that I have had longer than I anticipated, and I have no idea how to divest myself of it. Interestingly, 75% of the shares of this company are held by insiders or 5% owners.

TVIN is my last. It is down 25% since I bought it, and the chart doesn't look too hot. Earnings release are out on Nov. 8th, so 2 weeks from now. It's late, and I need to go to get up early, so I'll look at this more tomorrow.

Always perform your own due diligence before making any investment.

Tuesday, October 23, 2007

PCU

By the way, I was able to get back in on PCU. Cost me about 4.50 a share more than I got for the covered calls, but I'm already up 6.95% since yesterday. If you haven't looked at the chart on this one yet, look now. This stock has increased 159% in price alone this year, and on top of that it pays a $1.60 a share dividend quarterly. While the shows an occasional price dip from time to time, that's just a buying opportunity, it shows no evidence of slowing down.

Always perform your own due diligence before making any investment.

ISV

Still having trouble resisting the short term plays, even though I am sitting on a 3 that are down right now (EGHT, GNVC, NCST). Got in on a few shares of ISV for fun at $1.28.

By the way, got into MDR at 43.90, and am up almost 5% already in just a little over 24 hours. Can't beat that. I still think this is a safe play up to about $50.00.

Always perform your own due diligence before making any investment.

Sunday, October 21, 2007

McDermott International Inc ~ MDR

So, I had written 3 covered call options that expired on Friday. PCU got exercised, the other two did not. The exercise of PCU, left a big hole in my 30% allocation for blue chip growth. While I do need to cut back in other areas, I feel that I need to keep the blue chip growth allocation portion of my portfolio maxed, in order to get the most bang for my money, so I have spent this evening reviewing some options, and decided to invest in MDR.

Click here to review a business summary outlined by Yahoo. I just got home from spending the weekend with family in the Bay Area, so I am going to quickly lay out my reasons for choosing this stock, and then get to my review of my sell list, which wasn't done after close on Friday.

First of all, Friday was the 20th anniversary DATE of the crash of 1987 (the 20th anniversary DAY however falls on Monday). The fearful converted to cash in case history decided to repeat itself. Then this came out,13:50 Morgan Stanley says crude oil "likely to come down sharply"; has "overshot fundamentals" - Bloomberg.

and across the board, Oil stocks started dropping, some in the double digit percentage points. I'm seeing that keeping your head while other's panic is a key component to this game. I'm seeing this as a huge buying opportunity in the oil industry, so I decided to look for a new blue chip in that realm to invest in. I could have increased my position in NOV, but decided against it, as it is already a good size portion of my overall portfolio.

Technically, the chart for MDR looked good. It has had two splits in the past 2 years, one on 9/11/07, and another on 6/1/06. The 10 day displaced moving average has been above the 50 day since 8/10/07. I calculated the return this year, using Fridays closing number which had taken a $5.00 a share hit from the previous day, and found that even with that 8.42% loss in one day, the stock price had increased in value by an amazing 148% in one year! Digging a little further, I found that the stock had doubled in price between the months of May and October. That's 100% ROI in 5 months, which would be 240% annualized.

Now, MDR has announced that it will have an earnings call on November 8th, 9am eastern time. There is always some risk in purchasing a stock before earnings but here are a few points that I have found that I feel limit that risk.

Positive surprises equate into higher stock prices. MDR has had positive surprises on 11 out of their last 13 announced earnings, and has exceeded earning estimates for the third quarter in all 3 of the past 3 years. Back to the chart, the 50 day low is 54.09, and I see support around 54.00. With those two things in mind, and my willingness to risk up to 10% of my investment, I have decided that a buy price below $59.49 is acceptable for this investment. Since I am very unsure of how the market will react tomorrow (where there be more panic, or will the sharks be snapping up all the bargains they can once they realize the sky didn't fall), I am going to low ball my bid at about $54.25. That is down a bit from both the Friday close of $54.35 and the after hours price of 54.77, but above my support support number. I wont be disappointed if I don't get in at this price, but I am going to bottom fish for it a little bit before I chase it up.

Always perform your own due diligence before making any investment.

Thursday, October 18, 2007

Portfolio review continued.

Well, I managed to only purchase one new stock today, and sold off 3 (VM, LTUS, and GHDX). Didn't make my goal of just selling, but at least the net of the transactions was in the correct direction.

I did a little soul searching last night after I got locked out of here, and made a more concrete plan on my portfolio asset allocations.

35% Growth/Income: Current allocation in line, includes T, HTE, MVO, and UNWPX. I wont be adding to these positions, other than dividend reinvestments. I am looking to sell HTE in the $30-$34 dollar range. If I get that opportunity, I will find a replacement for it at that time.

30% Blue Chip Growth: Current allocations in line, PCU, NOV, RCI , MIR and NRG. I will most likely lose PCU and MIR due to the covered calls that I have out against them (a mistake I wont make again). I will replace those with some new picks from Navelliers Blue Chip Growth, newsletter, due out on October 22nd.

10% Zip Code Changers: These are my buy and hold pipe dreams, which are actually under allocated at this point, but I will not be filling them in, until I get the last category reigned in. Currently holding LBWR, ZMRAF, and SYBR.

25% Value / Short Term Trades: Here is my real weakness. The ideas in this category have been coming at me fast and furious, and I have been like a kid in a candy store, completely without any impulse control. I likie, gimme, has been my mantra the past few weeks. My focus is on trimming this area. I reviewed ASTM, CSCA, EGHT, GAI, AND GNVC in my post last night (though part of the GNVC research got lost), so on those 5 I will be brief.

ASTM: News out regarding some stem cell research. I expect the gap to fill and then some. For fun I have a 1.39 sell order out there, which would give me a 25% return on a 3 day trade. Not sure if it will click that high though, as there may be some resistance around 1.27 and 1.32.

CSCA: Pulled back slightly on no news. I assume it's just a little profit taking before the 20 year anniversary. I still like this stock.

EGHT: Chart looks good, and up again in after hours to 1.52. This one just feels like it wants to take off.

GAI: This stock is still not exciting me. Down on volume, so it may be being manipulated. 65% shares held by insiders. Looking for a graceful exit.

GNVC: Up in after hours, no news, chart looks good. I like the technical on this since I don't see any real resistance until 4, other than perhaps a bit at 3.25.

NOEC: This one has been testing my resolve, since I posted about the swing trades I was planning on this post. It is going lower on low volume, and has inside shareholders at 59%. I have an 8.70 sell in, and while I don't know when it will hit that number again, I have little doubt at this point that it will. I do see some resistance at 7.50 that I have to contend with though.

PRX: Looking for an out. The chart looks terrible. This was a buy based on insider trades and a press release. Hasn't been a good move so far.

TGB: I like this stock so much, that I bought it again even though I have already lost money on it once this year. It reached new highs, and I jumped on, to immediately watch the price dwindle. It's a copper play, and I like metals. This one continues to haunt me. Looking for a graceful exit.

TRMA: My feelings haven't changed much on this one since the last time I posted on it. I'm looking for a sale on the downside of whatever happens between $38 and $43. I am hitting some resistance at $35.40 I need to break through now.

YHGG: This was a kid in a candy store buy. Looking for an out.

NCST: My short term buy for today. Chart looks good, and up in after hours. Support around $2.16 while my 10% loss is at $2.48. Fifteen day low at 2.16. I feel like I bought this one too high, chasing it.

So, my lessons for myself today begin with no more trigger buys off the short term board. At the minimum, I want to know what my 15 day low and support levels are, then I want to put in my buy price so that my 10% loss lands around those levels. I think this strategy will help me in many ways. First of all, it will make me pause and see if it is really prudent to add another stock to my portfolio. Second, when the stock is added, I wont have to decide where to stop, since I will have made that choice by my purchase price. Thirdly, I think that being a more technically choosy about picking a buy price than just looking at the current level two quotes, I will not be getting into as many stocks, which is part of what I need...to limit this kid in the candy store reaction I am having to the multitude of earning opportunities that present themselves to me each day.

Always perform your own due diligence before making any investment.

Wednesday, October 17, 2007

Wednesday already

This week has really gotten away from me. I've definitely started off on the wrong foot as far as documenting what is happening during my trading day, and what I'm finding out during my nightly recaps. In fact, last night I did not do my nightly review of my portfolio, most specifically those on my sell list, and it did end up with me missing the fact that a sell order had expired, and I missed my chance to get out of NOEC at a slight gain. Now, I have a really tough decision to make on that one, but we'll get to that in due time.

This post may end up being a little long winded, but I want to go through and document each item on my sell list tonight, instead of just highlighting a couple. Since is growing each day, instead of getting culled back to around 10 stocks like I had planned, I need to really sit down and go through why I am holding each of these stocks with a fine tooth comb. For simplicity, I am going through them in alphabetical order.

ASTM: Source: Short Term Traders board goingin60 (this board requires a paid membership).

Short term traders board has become my new favorite message board, and part of the reason that I am having trouble whittling down my portfolio. There are some great ideas posted on that board throughout the trading day.

Anyway, saw this one thrown out there this morning. I saw that it had gapped down, and decided to take advantage of the possible gap fill. AT 1.12 a share, it seemed that downside could be kept to a minimum.

Tonight I find that the reason the price had gapped down was due to this news article.

Aastrom Direct Offering to Raise $13.5M

My initial reaction is that that is a good thing, and I would expect a gap fill now that the offering has closed. However, being new to the intricacies of how this type of thing effects future stock pricing, this will be a good one for me to watch closely. Did this offering dilute the shares enough that it doesn't easily bounce back? It's times like these that I realize I am just a little baby on this investment learning curve.

CSCA: Source, another IHUB board member, Bobwins. I really like this guys thorough approach to his due diligence. I get more than just ideas from him, I feel like I am really learning something about the things that I need to be looking for in a stock, when I read his posts.

Anyway, I have nothing but great things to say about CSCA. It's up 13.88% since I my purchase on 10/5/07 (12 days ago) at 10.85. It is up a China play, which is why I have it on my sell list (which is basically the list I keep for stocks I need to watch closely). Still no new news since September 6th. Other than that, lots of new highs, and a gap up with a nice finish today. The chart speaks for itself.

EGHT: Source goingin60, yes, I trusted the rainman on this one.

I saw it approaching the resistance at 1.52, with leaps up in the past few days, and decided to go for it. While it closed at 1.48, the same price I had bought it for in the morning, it has reached 1.54 in after hours. There is an earnings call on November 1, which is scheduled for 4:30pm EST. I am curious if calls like that after market close generally are going to be giving bad news, while earlier day calls give good news? That would be an interesting statistic to track!

Anyway, gonna keep an eye on this one, but with the solid support I am seeing around 1.25 for this stock, it just really doesn't seem to have much of a downside at the price I got in at.

Financially, they are showing increases each quarter over the past year in both total revenue and gross profit.

Then we see multiple insiders purchasing stock in August, just before the release in September of

Santa Clara-based 8x8 (NASDAQ:EGHT - News) said its platform "will be the only brand presented and promoted to the roughly 12,000 subscribers who will be left without VoIP phone service after the company winds down its VoIP operations over the next three months."I really can't think of anything more to add about this company. All the stars on this one seem to be aligned. I will watch it daily, and let it run. I'll sell it on the downhill side.

GAI: Another from the Short Term Trader board, and a friend, John. The chart is pulling back some, but on low volume. I've done my minimum digging around yahoo, and I'm not finding anything terribly compelling about holding on to this stock, other than the fact that 65% of it's shares are held by insiders. It's support is lower than I am comfortable with ($2.57), so I will be seriously reconsidering this position if it dips below 4.45 (10% loss on my investment).

GHDX: Source is vague on this one. It was a long term medical play I picked up from somewhere. The candle chart looks like it may be in for a downturn, including the 10 day moving average moving below the 50.

However it is supposed to be a long term play, and it has a few good points I may investigate further when I don't have so many stocks on my plate to look at. I will evaluate my position on this one if it breeches support at $19.00 (my cost was $19.25).

GNVC: Yet another gem from goingin60

Got in at 2.67. It closed at $2.82 and is up to 2.87 in after hours!

Well, I just spent the last 1/2 hour trying to unlock my computer. Apparently there is a limit to how heavily it will allow me to tax it. I know I had finished a write up on this stock, and started one on LTUS.

Well, folks, here it will have to end, as it is now after 1am, and I have to be up in less than 5 hours for stock market open. The fact that I am going to bed with 8 stocks unresearched alone should be proof that I am holding more stocks right now than I can realistically handle.

Here is hoping that I am successful tomorrow in gracefully exiting some of my lagging positions and resist the temptation of opening new ones. In fact, I will comit to myself right now that I will not even investigate a new stock pick until I have completed posting all of my findings on my sell list review.

Always perform your own due diligence before making any investment.

Saturday, October 13, 2007

Stock Trader's Almanac

My Stock Trader's Almanac 2008 arrived today. A great way to start my first day as a full time trader. Yes, that's right, after being on vacation for a week, and comparing the results to the results that I was achieving working on my portfolio part time, I called my boss yesterday and quit my part time job. An added bonus is that I will get to roll over my 401K into an IRA and be able to have more control over that part of our retirement package, than choosing between a handful of mutual funds.

Anyway, the Stock Trader's Almanac 2008 has a lot of great features, and I think that it is a good an investment for anyone wanting to make a real go of investing. One of the things that it stresses is that you will have more investment success if you write things down. Going back to my original post regarding the purpose of this blog, I can see that I am on the right track if I want to be successful in this endeavor. The second key to me being on the right track, is that it denotes November through January as the best three month span, right in line with me taking the dive to do this full time.

Some features of the 2008 Almanac that I am digging right now are

*2008 year at a glanceWhether you are new to investing, or a seasoned investor, Stock Trader's Almanac 2008

This shows you days the market is closed, option expiration dates and major holidays. Also includes the 2009 year at a glance towards the back of the Almanac.

*One page for each trading week, broken down by day.

What a great feature! You can incorporate your appointment calendar into the Almanac, making it more likely that you are looking at it on a daily basis. This part of the almanac also includes holidays, market profitability numbers, option expiration days, and icons that show days that have been 60% bearish or bullish on average during the past 21 years. Interspersed between all of this are Monthly statistics, and references to check other parts of the almanac such as Investor Seasonalities.

*Directory of trading patterns

This is the main reason I bought this book, was for the directory of trading patterns. Some of the patterns go back as far as 1900. Others not quite as far based upon data available, or a noticeable shift in patterns has occurred due to changes in the investment community (for example 401K availability increases)

*Strategy Planning and Record Section

Some really good spread sheets and checklists in this section. I am sure that I will be incorporating some of these into my tracking.

Always perform your own due diligence before making any investment.

Wednesday, October 10, 2007

Canadian Energy Trusts

Kiplinger ran an interesting article a week ago regarding Soaring Oil Trust Yields. Over 15% of my portfolio is in Harvest Energy Trust, who put out this latest press release. So, my dividends coming on October and November 15th are set in stone, but this is the first time in quite some time that HTE did not announce a quarters worth of dividends at one time.

I have known that I would possibly need to exit these positions some time in 2010, due to the Tax Fairness Plan, but the recent news of the Alberta tax increase from 25% to 30% has made me take pause. While I am not ready to abandon the consistent income and growth that I have achieved since my purchase of HTE, it has definitely led me to rethink my sell point.

Up until recently, last month, I was not reinvesting my dividends back into HTE. Best case scenario as I see it, the tax increase in Alberta of 5% translates to a dividend decrease of 5% to unit holders of HTE. Using that best case scenario, and my cost basis for the units that I currently hold, selling the units for $30.00 per share would net me the same amount as collecting dividends for the next 2 years. If I can squeeze $34.00 a share, that would be the same as collecting those dividends over a period of 3 years (putting us right before the January 1, 2010 Tax Fairness Plan kickoff).

HTE is on an upward swing. It has a 52 week high of 33.97. If it continues it's upward trend, I will sell at the best point I can find in that 30-34 dollar range.

Always perform your own due diligence before making any investment.

Noteworthy events for my portfolio

While the dow dropped today, my portfolio increased by 1.42% today. That's over 500% annualized, if that type of increase was sustainable all year long.

Anyway, I wanted to document a few stand out events that are occurring for some of my stocks.

Starting with TRMA, this stock finally broke through the resistance it has been feeling at $34.00 today, to end the day at $34.30. This is the break through that I have been waiting for. While there has already been a bit of a pull back in after hours trading, I am staying optimistic that this is the beginning of the run up to the low 40 range for this stock. I have revised my support level on this stock to 31.85, and see minor resistance at 37 and 39, but then nothing holding it down until it hits around $43. Even with the sell off the other day, a decent portion of my portfolio is riding on this stock.

CSCA first caught my eye on IHUB and so far is not disappointing. Since 10/3 it has made new highs each every day except for Monday, though it did match the previous days high. While it tends to close quite a bit lower each day than the high, it is still moving up at a consistent rate that I am quite pleased with.

For sheer volatility, NOEC is unmatched in my portfolio. Intra day swings have been crazy!

10/1 5.83 - 6.98 O 6.10 C 6.64

10/2 6.26 - 6.90 O 6.57 C 6.26

10/3 6.50 - 8.81 O 6.60 C 7.945

10/4 7.83 - 9.60 O 8.50 C 8.50

10/5 7.49 - 8.80 O 8.71 - 7.65

10/8 7.25 - 8.19 O 7.88 C 7.84

10/9 7.31 - 8.19 O 7.31 C 8.19

10/10 7.56 - 8.74 O 7.57-8.20

Since the beginning of October, it has been at or below 7.50 6 times, and at or above 8.70 four times. While risky, this shows me an opportunity to make some money based on this intra day volatility. I have put in a sell order for my shares at 8.70. Once it sells, I will place a buy order for 7.50 and try and ride the price up again. That is a 16 percent gain each time I can capitalize on that price move. I'll keep you posted on how that works out.

Well, that was a lot of good news, now for the bad news that should be good news...PCU.

The number of mistakes I have made since I first saw this stock are astronomical. I talked about some of them in another post. My most recent mistake was to sell Covered calls against the PCU stocks that I had owned.

You see, historically, October is the worst month in the stock market. I had accumulated some shares of PCU since my last blunder sell of it, at an average price of 105.72 per share. Since October is historically a bad month for the market, I decided to sell covered calls against PCU to make a few extra bucks. I sold the 120 October calls for $2.40. PCU is now at 135.46 per share, and the calls I sold for $2.40 would cost me $16.00 to buy back. This is a very hard lesson learned, and while I will make money when those options are exercised on October 20th, unless something crazy happens in the next few days, I will be selling those shares for much less than they are worth.

As I said the last time I posted about PCU, the chart shows no signs of slowing down.

Special note to PCU: On my honor, if I ever have the opportunity to own you again, I promise to treat you right!

Always perform your own due diligence before making any investment.

Sunday, October 7, 2007

China Plays

I picked up a couple of China plays on Friday. Both of them were from IHUB. CSCA applied for NASDAQ, and shareholders are currently voting on the acquisition of a profitable Chinese company. NOEC was the second China play I bought on Friday. Refer to my Wish List post for more information why I decided to pick this one up.

I reduced my position of TRMA by 40%. I was able to get 33.60 for it, which was very near the high for the day of 33.64. TRMA hasn't been that high in over a month. I don't like selling a position when it is on an upward swing and TRMA is moving up right now. It's made about 10% price increase in the past week. I did feel that I had too much of my money tied up in it for too long though. This is the third time I have owned TRMA in the past couple of years. It has a nice little wave that I like to ride occasionally to make a few dollars. It has pretty strong support in the 29-30 area (green arrows on the 2 year chart below), and will peak somewhere between 38 and 42 (pink arrows) before it heads south again.

I purchased it this time around when it was on an upswing (blue arrow around Sept 7th) thinking I would make a quick turn around. Unfortunately, I put my order in at night, went to bed, and spent the past month watching it test support and my resolve. I refused to sell it at a loss, because I knew it would eventually head up again, but when I got the opportunity to sell a portion of it at a profit, I took it. Now it's just a matter of waiting to see how high it goes. This is one of those stocks that I will use the way of the turtle method to find my sell point. I will be looking to sell it once it starts moving down off it's peak. I will expect to start watching it very closely once it hits 38, to see how high it goes before it turns around.

Anyway between that and my MVO post, I believe I am caught up on documenting my busy trading day on Friday.

Always perform your own due diligence before making any investment.

Friday, October 5, 2007

MVO

What a day! The employment data was well received, and my portfolio balance increased by 4.3% today (6.92% ROI month to date). I made several trades, swapping out some positions, and increasing others. My most notable new addition was RIMM, which gapped up today. Sometimes a stocks price will fall after a gap up, but this is a Navellier pick, and I am confident that even if it does dip, it will continue to increase in value.

The stock that I really want to talk about today is MVO. In my opinion, MVO is a good addition as an income investment. Since I need to generate some income from this portfolio for living expenses, I keep a percentage of income investments. HTE has been my number one income producing position. I began purchasing shares in February of this year, and have had 30.9% ROI (45.6% annualized). I enrolled HTE into the DRIP program this week, up until now I had not been reinvesting dividends.

HTE is a Canadian Energy Trust. Trusts avoid paying taxes by distributing a minimum of 90% of their proceeds to shareholders. There is a possibility however, that this tax exemption could end around 2009, 2010. There is also the possibility that the tax exemption is grandfathered in for companies like HTE, but not allowed for newer trusts. Here is a link to HTE's website.

Anyway, that brings us to MVO. MVO is an U.S. oil trust. MVO went public in January of this year. So far distributions since going public have been

12-Jul-07 $ 0.657 Dividend

12-Apr-07 $ 0.533 Dividend

13-Feb-07 $ 1.012 Dividend

Today, MVO announced a 3rd quarter dividend of $.65383330 per unit to shareholders of record on 10/15/07, payable 10/25/07.

Despite this announcement units of this trust actually decreased in price, on news of lower oil futures. I used that as an opportunity to double my position in MVO.

Anyone telling me that they had a little money to invest this month in a stock over a long term (a few years or more) I would recommend this to. First, based on my my postive experience with HTE. Secondly, because it has the same benefits as the Canadian Trusts, without the uncertainty of the tax situation. Thirdly, having gone public just this year, I feel like it is a good opportunity to get in near the ground floor. My understanding of oil companies is that the make money, or they make a lot of money, and in this case, those proceeds are being distributed to unit holders. By investing a set amount each month, you will be purchasing more shares when price is low, and less shares when the price is high, creating a dollar cost averaging. At the current price, this stock has a 10.77% dividend yield.

Unfortunately, perhaps because of it is so new, this stock does not qualify at Ameritrade for the automatic dividend reinvestment, so I would need to do this on my own. That could be prohibitive at a place like Ameritrade, if I did not have a number of free trades that I can make each year. Sharebuilder does not currently provide for the purchase of MVO. I made a request for it today, and will keep you posted as to whether or not they add it.

The chart for MVO looked really good, up until the futures news today. I am expecting this to be only a minor set back, and predict the stock price to rise this next week once people start hearing about the upcoming dividend distribution.

Thursday, October 4, 2007

Wish List Update

Well, tomorrow is the day that the employment data comes out, so I am waiting heart in throat to see what happens, and how the market reacts.

A lot of great ideas flew my way today, some I added to my watch list, and some I placed small orders for, as they were just too good for me to resist.

First thing this morning, I bought AFG Dec 30 calls for $1.10 apiece. I have been watching this one for a few weeks since I noticed some heavy insider trading. The stock was showing some resistance at $30.00, and has closed at $30.01. By purchasing call options, I was able to limit the amount of cash I was commiting to the trade, while still giving my self the opportunity to ride this up. The next level of resistance is at $35.00.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I added NOEC to my watch list yesterday. It continues to hit new highs, with large price swings during throughout the day. It has some support at 6.55, so I have put in an order there. I'm a bit leary about these China stocks, but a lot of the right people have been discussing this one. Louis Navellier whose advice has netted me a 7% roi in the past 10 weeks rates this a buy. That's more than 35% annually. 59% of the shares are owned by insiders or 5% owners. I've got my low ball bid in, and will keep an eye on this one. The chart shows no upward resistance, so it could go ballistic, or it could crash and burn.

Update 10/5/07: I did decrease one of my positions and get in on this one today at $7.70 on some light profit taking.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Checking the insider trades for yesterday, I found PRX. I like pharmaceuticals, they have some risk to them, so they are exciting. Here is a partial excerpt from Yahoo Financials on PRX.

The chart on PRX is awful. It gapped down on September 27th. On October 3rd 4 officers and 3 directors purchased a total of 94,300 shares. That's a lot of insiders committing a lot of money to their company. I've got this one on my watch list, and will be monitoring it. I'm looking for a gap fill here. There is not a lot of chatter on the IHUB board about this one, and Navalier rates it a sell. My account is too extended to even buy options on something this risky.Par Pharmaceutical Companies, Inc. develops, manufactures, and markets generic drugs and branded pharmaceuticals for specialty markets in the United States. The company offers generic prescription drugs comprising approximately 180 products representing various dosage strengths for approximately 80 separate drugs. Its principal generic drug products include fluticasone, amoxicillin, cabergoline, tramadol HCl and acetaminophen, quinapril, fluoxetine, ibuprofen Rx, lovastatin, megestrol oral suspension, cefprozil, paroxetine, mercatopurine, glyburide and metformin HCl, metformin ER, ranitidine, and tizanidine.

BUSINESS SUMMARY

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

CMGI got added to my stock list today because the CFO and the President of sales and marketing have purchased 150,000 shares between the two of them. They are planning a 10-1 reverse split in a month. Again this one gapped down. I would like to see it back up above 1.60, as it has no resistance again until about 2.40.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Well, as you can see I have more ideas than money. It's hard to not jump on every "great stock" I stumble across, but watching them here will help.

Always do your own due diligence before investing, and Good Fortune!

Wednesday, October 3, 2007

AFG

There may not be anything sexy about insurance, but the CEO of American Financial Group seems very fond of his company. He bought 6 million dollars worth of this stock for his family's trust on Friday, to add to the 250, 000 shares he had already purchased in September. Additional big blocks of shares had been purchased in July and August.

AFG insider trades

25% of this company is owned by insiders and 5% share holders. To me this all points to good things for this stock. Technically, the 10 day moving average crossed up over the 50 day moving average during September. I see a little resistance at $30.00, I would like to see it cross that mark.

Because I am still trying to sell off some of some stock, I can't purchase any now, but it is definitely on my wish list list, and I will be watching it closely.

As always, do your own due diligence before purchasing any stock.

AYSI

Alloy Steele International Inc. is an over the counter stock that I would consider a risky investment. Current price is 55 cents a share. I purchased this one yesterday at 61 cents, so I am down a little bit today, but I'm not concerned. It's down on low volume, after trending up on a couple of incredibly high volume days. Also, since prior resistance was at 55 cents, 55 is now a support level. A good lesson in patience for me here though, my initial reaction was to put in a bid at 55 cents, but I thought, what's a few pennies, and placed a bid that was between the current bid ask range instead. I could have saved myself a few dollars.

ASYI is a tip I got from my father, based on some information from the ihub board (see the link below).

http://investorshub.advfn.com/boards/read_msg.asp?message_id=23370777

I'm mostly a trend and technical trader, but the financials on this stock look good, from my limited eye.

http://finance.yahoo.com/q/is?s=AYSI.OB

A little bit about ASYI.

Alloy Steel International, Inc., together with its subsidiary, Alloy Steel Australia (Int.) Pty Ltd., engages in the manufacture and distribution of Arcoplate, a wear-resistant alloy overlay wear plate, primarily in Australia. It offers fused-alloy steel plates for installation and use in structures and machinery that suffer wear and hang-up problems. The company's customer base primarily includes companies involved in the mining and dredging industries. Alloy Steel International is also developing the 3-D Pipefitting Cladder process for depositing a profiled layer of wear resistant alloy onto interior surfaces of pipefittings, which are used in various industries. The company also distributes its products in the United States, South America, India, Indonesia, Singapore, South Africa, Japan, China, Canada, and Malaysia. Alloy Steel International was incorporated in 2000 and is based in Malaga, Australia.Another reason that this stock makes sense with my portfolio is that I have a good chunk of my money invested in the mining industry. If I am betting on them, it's not a huge leap to bet on the people that provide equipment for them.

I would say that this is not an investment for the faint of heart, and remember to always do your own due diligence before investing.

Tuesday, October 2, 2007

PWAV

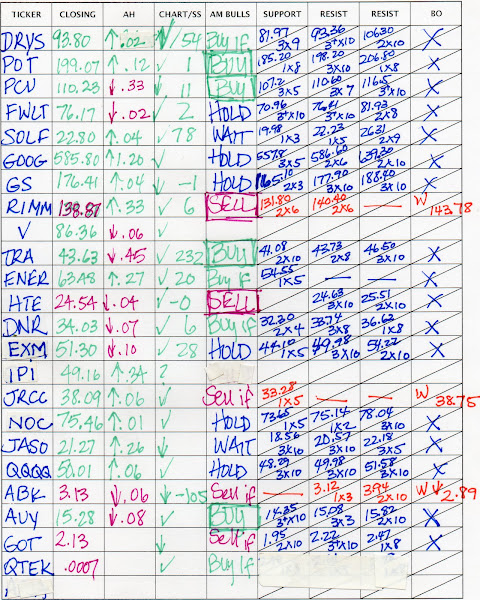

The market has been in an incredible uptrend, and I find myself in the position of holding too many stocks, 15 of them as of last night. I know that I need to get out of at least 5 of these positions. For a part time investor as myself, 10 seems to be a pretty fair number positions to keep track of. Some of my positions I consider low maintenance at the moment, but last night, between starting this blog I created a spread sheet of a few of the positions that I would like to get out of as gracefully as possible. Here is a a view of it, with the exact costs blacked out protect my privacy. (Right clicking the chart gives you the option of opening it in a new window).

Anyway, there are several possible points at which it may be a good idea to sell a stock. The first one I have listed is 10% loss. This is the point where you have lost 10% of your initial investment. You can use whatever number you are comfortable with. Sometimes I will allow a stock to dip lower, if it makes sense to, but I use the 10% as a rough guide that I am comfortable with. Here is some interesting information that I picked up at a class that I took. The information below tells you, based on a set amount of money, if you lose a certain percentage of one investment, the get even point of your next investment.

% loss of initial trade % gain needed on next trade

10........................................... 11

20........................................... 25

30........................................... 43

40........................................... 67

50........................................... 100

60........................................... 150

70........................................... 233

80........................................... 400

90........................................... 900

So, if you have 1000 dollars to invest, and you lose 10% that leaves you $900 for your next trade. You will have to make 11% on that trade to return to break even. As you can see by the chart above, the get even point becomes exponentially more difficult to achieve as your loss percent of the first trade increases.

The next column I have for a sell point lists the 15 day low. The idea behind this comes from the "Turtle Strategy"*. A successful futures trading strategy that was kept under wraps, until one of the "turtles" divulged the secret. This is a trend investment method, where you buy a stock when it is at a 20 day high, and sell it when it is at a 10 day low. Once this secret broke out many people were using it, so soon the market movers were forcing stocks to 10 day lows to buy stock at a bargain. Picking a random day close to that range is one way to avoid being sucked into that cycle, and still get out of a stock when it is on it's down trend. I am currently using 15 days, in hopes of avoiding selling too soon based on normal market fluctuations. This number of days fluctuates for me, but the principal is the same.

The third sell point I am looking at is the stocks support. This is the point on the graph that it appears the stock is able to stay above. In the case of PWAV (I will post the chart further down) I have a horizontal support line, but that is not always the case.

Because I am working part time, and I have so many stocks to watch at once, I then went into my Ameritrade account and set up e-mail alerts for each of the stocks on the list based on one or more of those 3 criteria. This way, whether I am at home or work, I will receive an e-mail when one of these three stocks cross that threshold.

If you have my spreadsheet open, you will see that PWAV has a 10% loss at $6.03, a 15 day low of $5.97 and support at $6.00. As you can see, all signs are pointing to me selling this stock if its price gets any closer to the $6.00 mark, so I made that my trigger. Sure enough, the e-mail came for me at work that the line had been crossed. I made the decision to sell the stock, I put in a market order, and got out at 5.992.

Let's look at the PWAV chart for the past year. Right click on the chart again if you would like a better view.

I will apologize now for my abhorrent paint skills. The green arrow shows you where I purchased this particular stock, on May 4th. This happened to be one of the first stocks that I found after learning about the Turtle system. I used Ameritrade's stock streamer to give me a list of stocks under 10 dollars a share that were in an upward trending mode. I liked what I saw on this stocks chart. It had just reached the highest high in several months, and the Displaced 10 day moving average had crossed up over the Displaced 50 day moving average. It was well above that line, and had been for a few weeks by the time I purchased it. It had a good run upward, peaking at $7.64 on August 8th. The purple horizontal line is what I considered support when I was looking at the chart last night. Had I reviewed this chart earlier, I would have placed support a little higher, probably around 6.25.

The stock gapped down on September 19th based on this article.

SANTA ANA, Calif.--(BUSINESS WIRE)--Powerwave Technologies, Inc. (NASDAQ:PWAV - News) today announced that it has priced its previously announced private placement of $130 million aggregate principal amount of convertible subordinated notes due 2027. In addition, the initial purchaser of the notes exercised its option to purchase an additional $20 million principal amount of the notes.When a stock gaps down like that, I don't like to jump on the band wagon. I like to wait a few days, and see how it plays out. Sometimes it is just people panicking, sometimes it continues downward. Since the gap down, the stock went under the support line twice, and third time is often the charm. It may go up, but based on the way the chart looks now, and my need to get out of several of my current positions, I used this opportunity to sell PWAV today. This is not a stock that I plan to revisit anytime in the future.

http://biz.yahoo.com/bw/070919/20070919005371.html?.v=1

One of the things that I have noticed over the past month or so of watching my stocks during this volatile market, is that the stocks seem to trade lower between 11 and 1 Eastern time. Below is todays chart of PWAV for an example.

I didn't consider this when I put in my market order to sell PWAV, since I was at work.

As you can see by the chart, I sold PWAV at the lowest part of the day. While the dollar amount difference between selling then and a couple hours later is miniscule for this trade, (about 11 cents a share in this case) for higher priced stocks, that difference can be much more substantial, so it is worth noting here for my future reference.

Once I had my

moment, I went out to Amazon, and put my order in for the Stock Trader's Almanac 2008

moment, I went out to Amazon, and put my order in for the Stock Trader's Almanac 2008"The Stock Trader's Almanac is a practical investment tool that has helped traders and investors forecast market trends with accuracy and confidence for over 40 years. Organized in an easy-to-access calendar format, the 2008 Edition contains historical price information on the stock market, provides monthly and daily reminders, and alerts users to seasonal opportunities and dangers. For its wealth of information and authority of its sources, the Stock Trader's Almanac stands alone as the guide to intelligent investing.All in all, even though I lost money on this trade, I would still call it successful. I am not unhappy at the point I got into the stock, and I believe that I gave it a good chance to show what it could do. The system I used to trade this stock is meant to maximize gains, and minimizes losses. All in all, I believe that objective was achieved, and a few inexpensive lessons were learned.

* To learn more about the Turtles, here is a link to Russel Sands website.

Way of the Turtle by Curtis Faith

Margin - It's such a scary word.

I have been investing online for as many years as I have had access to the internet. Due to budgeting and time constraints I was limited to *DRIP types of investments, where I would pick a stock, and then invest a particular dollar amount at the same time each month resulting in dollar cost averaging of my stocks. What I found was that with my limited knowledge of reading charts and financial reports, I was able to pick stocks that were winners a high percentage of the time. Up until February of this year, I had never dealt with the question of what price to buy a stock, it was purchased when the plan decided to purchase it. I didn't decide when to sell the stock. If I sold it, it was because I needed the money, or in one case only, the stock turned out to be such a dog that I unloaded it.

So, when we made this decision in February that I would spend time managing my portfolio, I knew I had a lot to learn. I needed to learn more about reading graphs and financials, and if I was going to meet my goal of realized gains each month of **X dollars, I had a lot of learning to do.

I'm not afraid to admit, just the utterance of the word 'margin' scared me. I had visions of the elusive 'margin call' coming, where men in black came to my door and said I had to make a choice, either my husband lost a pinkie, or I signed over the deed to my house. When I began this journey, my account was not even approved for margin trading.

What did that mean? That meant that each month when it came time to transfer X number of dollars from my account, I had to make sure that I had the cash available, and felt that I needed to make realized gains for that month to cover my financial needs. Only this way did I think I would be "successful".

What I found was that that mindset put me in the position of selling stocks that were down, knowing that they would rebound, or taking gains way before I should have. A classic example of this faux pas was the mistake that I made with PCU. I first purchased this stock in March for 65.25 a share. 6 days later I was able to sell the stock for 69.45 a share. With a trade I had made earlier that same month, I had met my goal of **X realized gains for that month. I beamed with pride at my ingenuity and accuracy in stock picking. Today not only was the high for PCU 129.37 a share, but between the time I sold the stock, and the today, I would have received two dividend payments of 1.20 a share. Holding on to that stock today (which by the way is still not showing that it will be slowing down any time soon) would have increased my portfolio value by 6 times **X in 7 months, for just one stock.

It took a little while for all of this to sink in, but eventually I realized that while I was doing well at minimizing my risk, I was not doing the second step of the equation, and maximizing my reward. Due to making decisions based on an incorrect goal, and fear of the unknown, I greatly reduced the amount of money that I could have made in 2007.

A good philosophy that I read somewhere, is to never allow the interest that you are paying per month on your margin exceed your dividend income. I like this as a guide for now, and feel that by utilizing some margin, to purchase stock or pay household expenses rather than selling a stock too early to be able to boast a realized gain, is a better strategy for what I am attempting to accomplish, which is to provide the X dollars that I am not collecting in a paycheck anymore for household expenses without depleting (and hopefully increasing) the balance in the portfolio account.

The stock mentioned in this post may not be suitable for all investors. As always, do your own due diligence before investing in any stock.

*DRIP refers to Dividend Re-Investment Plan: For more information

http://beginnersinvest.about.com/od/dividendsdrips1/a/aa040904_5.htm

**X refers to the amount of money each month I need to withdraw from the portfolio account in order to cover household expenses that were previously covered by my salary.

Monday, October 1, 2007

The Beginning

Goal setting.

The reason most people never reach their goals is that they don't define them, or ever seriously consider them as believable or achievable. Winners can tell you where they are going, what they plan to do along the way, and who will be sharing the adventure with them.It always has to start there. You have to know what you want, and formulate a plan to try and achieve it.

Denis Watley

My husband and I have been on track to meeting our goal of retiring at age 55. A fairly recent event that I wont detail here gave us some unexpected investment capital. Together we decided that I would reduce my work week at my current employer to 25 hours a week from 40, and I allocate the remainder of my work week to the management of our portfolio. My initial goal was to make enough money to replace the income that I make punching a clock, with investment income.

During the past 8 months I have made some mistakes, and had some triumphs. Obviously I am a planner. In addition, I am an organization nut. I have spread sheets for the hard facts of my progress organized. Monthly spreadsheets show my dividend income, and realized gains for each month. A summary worksheet shows the balances and cash flow of this portfolio account. I subscribed to two newsletters, and have a spreadsheet for each that tracks my gains and losses for stocks purchased based on their recommendations.

Up to this point what I haven't been able to do is find an acceptable format for logging my "soft" facts. What was the date, source and current price of that stock that I added to my watch list? Why didn't I purchase it instead of just adding it to the list? Was the price too high? Was the chart bouncing around the support line? When did I first notice the stock, and what price was it at? Who or what was the source of the pick? In other words, what criteria must this stock meet in order for me to purchase it?

While my monthly spreadsheets show that September was the most successful month I have had so far investing, what it doesn't say is why. What did I do different? What did I do well, and what could have been improved?

So, if you have made it this far through my initial blog post, you can see that part of the reason for starting this blog is to have a single place to organize my thoughts in regards to my portfolio for easy reference. There is more though. Some friends have showed some interest in what I am doing, and how I do it, so I thought this was a good way to document what is going on in my portfolio, and my mind.

In case it is not abundantly clear, I am not a professional, and posts made regarding specific stocks are not recommendations. Some of the stocks I will be discussing are high risk, and not suitable for all investors. Before investing in any stock, do your own due diligence.