Anything on this list came from a screener on bullish chart patterns with over 1,000,000 volume, and then was cross referenced to Navellier's stock grading system, and he denotes it as an A.

DO: Harami Bullish (same pattern AGU had when I sent out that e-mail, the JAN 150 calls are around $3.00 right now, and the 155's are under $2.00)

ELON: 3 white soldiers (the JAN 25 calls are less than $1.00)

TBSI: Reversing long downward trend (JAN 40 calls around $1.00)

ADM: 3 days at 52 week High (the 50 calls are around .50, the 45 calls are less than 3.00 and in the money.)

SDTH: New highs plus High earnings growth (no options available)

The following stocks showed up on a screener called Bull Bull Bull, which wasn't specific as to what it was screening, other than "strong stocks exhibiting strength). Some good stocks show up on it though.

AMSC

CYBS

DE

HES* (showed up on my screener last week too)

MOS

POT

SOLF

TSL

ZOLT

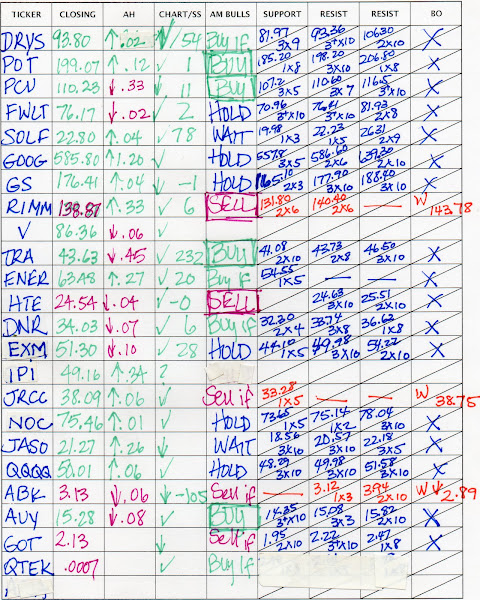

So, here are a few notes from my portfolio grader analysis.

ADM and SDTH have the best cash flow.

TBSI had the best overall scores, only 2 areas were not an A. Unfortunately they also had the worst cash flow.

I will definitely be playing DO calls next week. ELON calls are cheap so I may throw in a few of those too I haven't decided.

As for the rest, I'm going to spend some more time this weekend, and pick one or two to add to my IRA.

FRO has a great dividend (12%) and is also on my watch list for IRA.

Always perform your own due diligence before making any investment.

Saturday, December 29, 2007

Bullish picks for next week

12/24/2007-12/28/2007 Round Trip Options

I was planning on taking Christmas week off, but couldn't resist popping in a couple of times to make some trades.

12/24/07

AGU calls gain 1.05

12/27/07

RIMM puts gain .45

SOLF puts lose .70

Always perform your own due diligence before making any investment.

12/17/07 - 12/21/07 Roundtrip Option Plays

Hope you all had a great holiday. We had an eventful one. Thought I would take some time to catch up on my bookkeeping today, including a few missing tracking posts on this blog.

12/21/07 was option expiration, so I did more equity trades than option trades this week, but for what it's worth, here they are.

12/17/07

RIMM puts gain 1.00

PCU calls loss .50

GOOG call loss 1.40

GOOG call loss .60

12/18/07

GOOG puts loss 1.00

GOOG calls loss .50

RIMM calls gain .50

GS puts gain 1.00

12/19/2007

FWLT calls loss .20

MS loss .20

I finally got smart after the 19th and stopped playing options the rest of the week. As you can see I had more losing than winning trades this week, further demonstrating that not playing options on expiration week is a good idea.

Always perform your own due diligence before making any investment.

Saturday, December 15, 2007

12-10-07 to 12-14-07 Round Trip Option Plays

This post is a summary of the round trip option plays that I made this week. While it does not include all trades I made this week, I am throwing in option plays that I held over one night. While these are technically not round trips, I am going to include them in this first posting anyway, since I am still getting the hang of doing these round trip option trades.

By date

12/10/07

*GOOG puts gain 2.59

12/11/07

POT puts gain .35

12/12/07

POT calls gain 1.00 (held overnight)

POT calls gain .70

12/13/07

GOOG puts gain .50

GOOG calls gain .20

RIMM calls gain .30 (held overnight)

12/14 (Friday before option expiry, time decay killed my gains on these two).

PCU puts gain .20

RIMM puts gain .30

OK, after posting all these in one place I see that I have made gains on all of my round trips. I think part of this is because I have been holding some of my bad plays over before this week, instead of taking the loss the day I bought. I want to be up front that I am transitioning to this type of trading right now, and I do not expect to have only gains on every trade I make every week.

*Note: Since Google options are much more expensive than the other options I play, their target is higher. Also, this is the first week I have traded GOOG options, so I made a few rookie mistakes on the trades I made on the 13th. Most notably, GOOG options go in 10 increments, instead of 5, so they resist differently.

Always perform your own due diligence before making any investment.

Round Trip Options

Well, after a couple of months of trial and error, I am finding that I have the most success with round trip option plays. What this means is that I pick an option play (or two) and execute the buy and the sell both within that trading day. This is definitely not a strategy to try if you are working a full time day job, since it is based on following the momentum of a moving stock, and jumping on and off within the swing.

My mantra has been no fear, no greed in order to get myself to an even playing field on the market. The problem with that combination, is that I am limiting my upside, and not my downside. By not selling within the same day if the stock is not moving the way I thought it would, I end up holding bad option plays, sometimes for weeks and losing an incredible amount of time value.

Another thing to note is that time decay seems to speed up starting the Friday before option expiry, and can be felt even within the day. This holds true for options out a month as well, as I found out yesterday when I played some January puts on a couple of round trips.

My current way of handling my round trips is that I find an in on an option by watching the corresponding stocks level twos. Once my order is filled I immediately put in a sell order for 1.00 gain. I continue to watch the stock, and if I feel for some reason that target is not achievable within the time frame of one day, then I will lower that target appropriately.

My current problem seems to be with minimizing my downside. I put in an alert to sound if the bid on my option reaches a point that is 1.00 less than what I asked, and make the necessary strategic adjustments. This is a kind of feel thing, however, since the market can turn on a dime these days.

Anyway, I started my own board on IHub to see if I can find other people that do this type of trading to share ideas with here.

Roundtrip Options

I have decided to post my weekly round trip results here on the blog, and link the message box to the post for that week for anyone that is interested in following my progress. I have decided to use the dollar gain per share per contract on the posts. I do not always buy the same number of contracts, or spend the same dollar amount in total, so using percentages on their own could be deceiving I think.

Good fortune!

Always perform your own due diligence before making any investment.

Thursday, December 13, 2007

Merry December Everyone!

Did that sound forced? If it did it is because it is.

December is historically a difficult month for me. I tend to either fall ill or injure myself. This time it was an injury.

Anyway, I have been trading every day, and learning a lot. I have a few bad trades to clean out of my account the best that I can the next week, and then I'm taking some time off trading until the beginning of the year to spend with hubby and do the Christmas thing with some family and friends.

I have a lot of information that I need to document soon on what I have learned this past month, but I'm not going to attempt that on these pain killers!

Have a wonderful Holiday season, and I should be back to more regular updates after the New Year.

Always perform your own due diligence before making any investment.